του Νίκου Oικονομίδη

Καθημερινή

31 Δεκεμβρίου 2011

Μπαίνοντας στον τρίτο και δυσκολότερο χρόνο της κρίσης, επικεντρώνομαι σε τρεις μόνο προτάσεις για το τι πρέπει να αποφύγουμε με κάθε τρόπο και για το τι πρέπει να προσπαθήσουμε πάση θυσία.

Τι πρέπει να αποφύγουμε πάση θυσία; Την έξοδο απ’ το ευρώ. Αυτός είναι ο πρώτος στόχος.

Πέρα από τους σημαντικότατους πολιτικούς και εθνικούς λόγους που βάζουν την Ελλάδα στον πυρήνα της Ευρώπης, οι οικονομικοί λόγοι είναι εξίσου σημαντικοί.

Τι θα συμβεί αν βγει η Ελλάδα από το ευρώ; Πρώτο, η Ελλάδα δεν θα πάει «πίσω στη δραχμή» με την παλιά ισοτιμία των 340,750 δραχμών ανά ευρώ άλλα στη Νέα Δραχμή (ΝΔΡ) με ισοτιμία 1.000 ΝΔΡ ανά ευρώ. Αυτό σημαίνει ότι όλα τα εισαγόμενα προϊόντα (και πολλά ελληνικά παρόμοια) θα πουλιούνται ξαφνικά σχεδόν τρεις φορές πιο ακριβά από σήμερα. Οι Ελληνες θα γίνουν ξαφνικά 60% φτωχότεροι. Δεύτερο, η Ελλάδα, μην μπορώντας να δανειστεί από την Ε.Ε. ή από τις χρηματαγορές, θα τυπώσει μαζικά νέες δραχμές για να πληρώσει μισθούς και συντάξεις, με αποτέλεσμα τον υπερπληθωρισμό και μακροχρόνιες βλάβες της οικονομίας. Τρίτο, και πολύ σημαντικό, αναμένοντας την έξοδο της Ελλάδας από το ευρώ, οι Ελληνες θα αποσύρουν τις καταθέσεις τους (όσες λίγες έχουν μείνει) από τις τράπεζες φοβούμενοι την υποχρεωτική μετατροπή τους σε νέες δραχμές ποιος ξέρει με ποια ισοτιμία. Η συνεπόμενη κατάρρευση των ελληνικών τραπεζών (πριν ακόμα κυκλοφορήσει η νέα δραχμή) θα είναι καταστροφική για την Ελλάδα. Αρα η έξοδος από το ευρώ είναι καταστροφή. Αντίθετα, μέσα στο ευρώ η Ελλάδα δανείζεται με πολύ συμφέροντες όρους και της δίνεται χρόνος να ανάκαμψη.

Ακόμα κι αν τα πράγματα πάνε πολύ στραβά και αναγκαστεί η Ελλάδα να φτάσει στην ανεξέλεγκτη χρεοκοπία, πάλι δεν πρέπει να φύγει από το ευρώ. Αν γίνει ανεξέλεγκτη χρεοκοπία, η Ελλάδα θα αποκοπεί εντελώς από το διεθνές τραπεζικό σύστημα, και θα αναγκαστεί να δημιουργήσει πλεόνασμα στον δημόσιο τομέα. Για να γίνει αυτό, θα χρειαστούν επώδυνες περικοπές στις κρατικές δαπάνες. Ομως είναι πολύ καλύτερα να παραμείνει η Ελλάδα στο ευρώ και να μειώσει τον δημόσιο τομέα κατά 20-30% σαν αποτέλεσμα της ανεξέλεγκτης χρεοκοπίας, παρά να φτάσουμε στο χάος της διάλυσης των τραπεζών, στην περικοπή της αγοραστικής δύναμης όλων των Ελλήνων κατά 60%, και στον υπερπληθωρισμό αν η Ελλάδα βγει από το ευρώ.

Περισσότερα

Saturday, December 31, 2011

Τι πρέπει να αποφύγουμε και τι να προσπαθήσουμε

∆εν φταίνε οι αγορές, φταίει η αβεβαιότητα

του Δημήτρη Καρυαμπά

Το Βήμα

31 Δεκεμβρίου 2011

Ενα έτος (2011) γεµάτο από νέες οικονοµικές έννοιες για τους περισσότερους, διαρκείς αγώνες µε τις διαβόητες «αγορές», νέες ρυθµιστικές αρχές-νοµοθεσίες και µια σταθερά (οικονοµική και πολιτική) η οποία µε δυσκολία θα τεθεί υπό διαχείριση-έλεγχο το ερχόµενο έτος: την Αβεβαιότητα.

Η αυλαία του έτους «κλείνει» µε το περίφηµο PSI. Οι διαπραγµατεύσεις πιο σκληρές αυτή τη φορά.

Η αγορά παρουσιάζεται για ακόµη µια φορά ως τέρας. Θα δανειστώ τα λόγια του Α. Χατζή από το άρθρο «12 Μύθοι για την Αγορά»: «Στο συλλογικό φαντασιακό έχουν αναλάβει τον ρόλο του µπαµπούλα που τροµοκρατεί τους πολίτες, τις κυβερνήσεις, ακόµη και τους διεθνείς οργανισµούς». Μια άλλη περιγραφή δίνεται από το Economist: «Η αγορά αποτελείται από... απερίσκεπτα θηρία, των οποίων η εµµονή µε τους αριθµούς είναι µια µορφή αυτισµού». Πόσες φορές δεν έχω δεχθεί την ερώτηση: «Γιατί η αγορά επιτίθεται τώρα στην (λ.χ.) Ιταλία;».

Οι πολιτικές αποφάσεις που πάρθηκαν το 2011 οδήγησαν σε όλες τις περιπτώσεις σε αύξηση της αβεβαιότητας, µίας από τις βασικότερες έννοιες της Χρηµατοοικονοµικής. Η εύλογη λοιπόν ερώτηση που δηµιουργείται: «είναι κακή η αγορά ή υπάρχει παντελής άγνοια βασικών οικονοµικών εννοιών και αρχών βάσει των οποίων δρουν τα µέλη της;».

Περισσότερα

Το Βήμα

31 Δεκεμβρίου 2011

Ενα έτος (2011) γεµάτο από νέες οικονοµικές έννοιες για τους περισσότερους, διαρκείς αγώνες µε τις διαβόητες «αγορές», νέες ρυθµιστικές αρχές-νοµοθεσίες και µια σταθερά (οικονοµική και πολιτική) η οποία µε δυσκολία θα τεθεί υπό διαχείριση-έλεγχο το ερχόµενο έτος: την Αβεβαιότητα.

Η αυλαία του έτους «κλείνει» µε το περίφηµο PSI. Οι διαπραγµατεύσεις πιο σκληρές αυτή τη φορά.

Η αγορά παρουσιάζεται για ακόµη µια φορά ως τέρας. Θα δανειστώ τα λόγια του Α. Χατζή από το άρθρο «12 Μύθοι για την Αγορά»: «Στο συλλογικό φαντασιακό έχουν αναλάβει τον ρόλο του µπαµπούλα που τροµοκρατεί τους πολίτες, τις κυβερνήσεις, ακόµη και τους διεθνείς οργανισµούς». Μια άλλη περιγραφή δίνεται από το Economist: «Η αγορά αποτελείται από... απερίσκεπτα θηρία, των οποίων η εµµονή µε τους αριθµούς είναι µια µορφή αυτισµού». Πόσες φορές δεν έχω δεχθεί την ερώτηση: «Γιατί η αγορά επιτίθεται τώρα στην (λ.χ.) Ιταλία;».

Οι πολιτικές αποφάσεις που πάρθηκαν το 2011 οδήγησαν σε όλες τις περιπτώσεις σε αύξηση της αβεβαιότητας, µίας από τις βασικότερες έννοιες της Χρηµατοοικονοµικής. Η εύλογη λοιπόν ερώτηση που δηµιουργείται: «είναι κακή η αγορά ή υπάρχει παντελής άγνοια βασικών οικονοµικών εννοιών και αρχών βάσει των οποίων δρουν τα µέλη της;».

Περισσότερα

Europe at the Brink - A WSJ Documentary

Wall Street Journal

December 30, 2011

In this documentary, Wall Street Journal editors and reporters examine the origins of Europe's debt crisis and why it spread with such ferocity to engulf much of the continent and threaten the entire world.

More

December 30, 2011

In this documentary, Wall Street Journal editors and reporters examine the origins of Europe's debt crisis and why it spread with such ferocity to engulf much of the continent and threaten the entire world.

More

Ευρώ: ένα νόμισµα χωρίς κράτος

του Γιάννη Στουρνάρα

Το Βήμα

31 Δεκεμβρίου 2011

Η χρηµατοπιστωτική κρίση και η κρίση δηµοσίου χρέους της ευρωζώνης οφείλονται στο βασικό πρόβληµα της αρχιτεκτονικής της. ∆ηλαδή ότι αποτελεί « ένα νόµισµα χωρίς κράτος », χωρίς ενιαία πολιτική δηµοσίου χρέους, χωρίς έναν «ύστατο δανειστή» σε περίπτωση ανάγκης όπως η σηµερινή, χωρίς έναν δηµοσιονοµικό πυλώνα ισοβαρή µε την Ευρωπαϊκή Κεντρική Τράπεζα (ΕΚΤ). Αυτή η ασυµµετρία δεν δηµιουργούσε προβλήµατα όσο οι χρηµατοπιστωτικές αγορές χρηµατοδοτούσαν τα ελλείµµατα του ισοζυγίου τρεχουσών συναλλαγών των µελών της ευρωζώνης, σήµερα όµως εξελίσσεται σε παράγοντα αποσταθεροποίησής της. H Ελλάδα ήταν απλώς η αφορµή της κρίσης, όχι η αιτία. Τέσσερις αρχές απαιτούνται να υιοθετηθούν για την αποκατάσταση της ισορροπίας.

1. Η λειτουργία της ΕΚΤ ως ύστατου δανειστή. Με τις συνθήκες που επικρατούν σήµερα, αυτή η λειτουργία δεν θέτει σε κίνδυνο τον στόχο του χαµηλού πληθωρισµού.

2. Η έκδοση ευρωοµολόγου. Ουδείς έγκυρος οικονοµολόγος σήµερα πιστεύει ότι το ευρώ θα επιβιώσει χωρίς ευρωοµόλογο. Οµως η γερµανική κυβέρνηση έχει αυτοπαγιδευθεί στην αρχική ρητορική της και δεν θέλει ούτε να αναφέρει τη λέξη αυτή. Επειδή όµως οι χρηµατοπιστωτικές αγορές δεν αποδέχονται πλέον ηµιτελείς λύσεις και είναι αρκετά πιθανόν να δοκιµάσουν σύντοµα τις αντοχές µιας µεγάλης περιφερειακής χώρας της ευρωζώνης, το ευρωοµόλογο είναι sine qua non για την επιβίωση του ευρώ.

3. Η σταδιακή δηµοσιονοµική (και πολιτική) ενοποίηση, µε τροποποίηση των συνθηκών και τη δηµιουργία ενός υπουργείου Οικονοµικών της ευρωζώνης.

Περισσότερα

Το Βήμα

31 Δεκεμβρίου 2011

Η χρηµατοπιστωτική κρίση και η κρίση δηµοσίου χρέους της ευρωζώνης οφείλονται στο βασικό πρόβληµα της αρχιτεκτονικής της. ∆ηλαδή ότι αποτελεί « ένα νόµισµα χωρίς κράτος », χωρίς ενιαία πολιτική δηµοσίου χρέους, χωρίς έναν «ύστατο δανειστή» σε περίπτωση ανάγκης όπως η σηµερινή, χωρίς έναν δηµοσιονοµικό πυλώνα ισοβαρή µε την Ευρωπαϊκή Κεντρική Τράπεζα (ΕΚΤ). Αυτή η ασυµµετρία δεν δηµιουργούσε προβλήµατα όσο οι χρηµατοπιστωτικές αγορές χρηµατοδοτούσαν τα ελλείµµατα του ισοζυγίου τρεχουσών συναλλαγών των µελών της ευρωζώνης, σήµερα όµως εξελίσσεται σε παράγοντα αποσταθεροποίησής της. H Ελλάδα ήταν απλώς η αφορµή της κρίσης, όχι η αιτία. Τέσσερις αρχές απαιτούνται να υιοθετηθούν για την αποκατάσταση της ισορροπίας.

1. Η λειτουργία της ΕΚΤ ως ύστατου δανειστή. Με τις συνθήκες που επικρατούν σήµερα, αυτή η λειτουργία δεν θέτει σε κίνδυνο τον στόχο του χαµηλού πληθωρισµού.

2. Η έκδοση ευρωοµολόγου. Ουδείς έγκυρος οικονοµολόγος σήµερα πιστεύει ότι το ευρώ θα επιβιώσει χωρίς ευρωοµόλογο. Οµως η γερµανική κυβέρνηση έχει αυτοπαγιδευθεί στην αρχική ρητορική της και δεν θέλει ούτε να αναφέρει τη λέξη αυτή. Επειδή όµως οι χρηµατοπιστωτικές αγορές δεν αποδέχονται πλέον ηµιτελείς λύσεις και είναι αρκετά πιθανόν να δοκιµάσουν σύντοµα τις αντοχές µιας µεγάλης περιφερειακής χώρας της ευρωζώνης, το ευρωοµόλογο είναι sine qua non για την επιβίωση του ευρώ.

3. Η σταδιακή δηµοσιονοµική (και πολιτική) ενοποίηση, µε τροποποίηση των συνθηκών και τη δηµιουργία ενός υπουργείου Οικονοµικών της ευρωζώνης.

Περισσότερα

H παραμονή μας στο ευρώ είναι μονόδροµος

του Γιώργου Α. Προβόπουλου

Το Βήμα

31 Δεκεμβρίου 2011

Η είσοδος της Ελλάδας στην ΟΝΕ και η υιοθέτηση του κοινού ευρωπαϊκού νοµίσµατος ήταν ένα σηµαντικό ορόσηµο στη µεταπολεµική ιστορία, που επικύρωσε την ευρωπαϊκή πορεία της χώρας. Το γεγονός αυτό διαµόρφωσε µια νέα πραγµατικότητα στην οποία έπρεπε να προσαρµοστούµε για να εκµεταλλευθούµε τις µεγάλες ευκαιρίες που δηµιουργούσε ένα ισχυρό διεθνές νόµισµα.

Με την υιοθέτηση του ευρώ (αλλά και κατά τη διάρκεια της προετοιµασίας για την είσοδο στην ΟΝΕ) η χώρα µας πέτυχε σηµαντική αποκλιµάκωση του πληθωρισµού, η οποία συνέβαλε στην αύξηση των επενδύσεων και στην επιτάχυνση του ρυθµού οικονοµικής ανάπτυξης. Παράλληλα, ενισχύθηκε σηµαντικά η πρόσβαση του Ελληνικού ∆ηµοσίου στις αγορές οµολόγων, ενώ µειώθηκε ουσιαστικά και το κόστος χρηµατοδότησης για τις επιχειρήσεις και τα νοικοκυριά, µε αποτέλεσµα να ενισχυθούν οι επενδύσεις αλλά και η κατανάλωση.

Τέλος, µε την εξάλειψη του συναλλαγµατικού κινδύνου, η συµµετοχή στο κοινό νόµισµα επέφερε µείωση του κόστους για το εµπόριο και τις επενδύσεις. Αποτέλεσµα αυτών των αλλαγών ήταν η ισχυρή ανάπτυξη, που διήρκεσε περίπου µία δεκαετία.

Ωστόσο τα µεγάλα οφέλη πουαπεκόµισε η χώρα από τη συµµετοχή στη ζώνη του ευρώ υπονοµεύθηκαν από αστοχίες καιπαραλείψεις της οικονοµικής πολιτικής, η οποία δενέλαβε σοβαρά υπόψη τανέα δεδοµένα που επέβαλλε η υιοθέτηση κοινής νοµισµατικής πολιτικής.

Η σηµαντικότερη από τις αλλαγές αυτές ήταν ότι, µε δεδοµένη τη νοµισµατική πολιτική, το βάρος για τη διόρθωση των ανισορροπιών ανελάµβανε πλέον εξ ολοκλήρου η δηµοσιονοµική και διαρθρωτική πολιτική.

Περισσότερα

Το Βήμα

31 Δεκεμβρίου 2011

Η είσοδος της Ελλάδας στην ΟΝΕ και η υιοθέτηση του κοινού ευρωπαϊκού νοµίσµατος ήταν ένα σηµαντικό ορόσηµο στη µεταπολεµική ιστορία, που επικύρωσε την ευρωπαϊκή πορεία της χώρας. Το γεγονός αυτό διαµόρφωσε µια νέα πραγµατικότητα στην οποία έπρεπε να προσαρµοστούµε για να εκµεταλλευθούµε τις µεγάλες ευκαιρίες που δηµιουργούσε ένα ισχυρό διεθνές νόµισµα.

Με την υιοθέτηση του ευρώ (αλλά και κατά τη διάρκεια της προετοιµασίας για την είσοδο στην ΟΝΕ) η χώρα µας πέτυχε σηµαντική αποκλιµάκωση του πληθωρισµού, η οποία συνέβαλε στην αύξηση των επενδύσεων και στην επιτάχυνση του ρυθµού οικονοµικής ανάπτυξης. Παράλληλα, ενισχύθηκε σηµαντικά η πρόσβαση του Ελληνικού ∆ηµοσίου στις αγορές οµολόγων, ενώ µειώθηκε ουσιαστικά και το κόστος χρηµατοδότησης για τις επιχειρήσεις και τα νοικοκυριά, µε αποτέλεσµα να ενισχυθούν οι επενδύσεις αλλά και η κατανάλωση.

Τέλος, µε την εξάλειψη του συναλλαγµατικού κινδύνου, η συµµετοχή στο κοινό νόµισµα επέφερε µείωση του κόστους για το εµπόριο και τις επενδύσεις. Αποτέλεσµα αυτών των αλλαγών ήταν η ισχυρή ανάπτυξη, που διήρκεσε περίπου µία δεκαετία.

Ωστόσο τα µεγάλα οφέλη πουαπεκόµισε η χώρα από τη συµµετοχή στη ζώνη του ευρώ υπονοµεύθηκαν από αστοχίες καιπαραλείψεις της οικονοµικής πολιτικής, η οποία δενέλαβε σοβαρά υπόψη τανέα δεδοµένα που επέβαλλε η υιοθέτηση κοινής νοµισµατικής πολιτικής.

Η σηµαντικότερη από τις αλλαγές αυτές ήταν ότι, µε δεδοµένη τη νοµισµατική πολιτική, το βάρος για τη διόρθωση των ανισορροπιών ανελάµβανε πλέον εξ ολοκλήρου η δηµοσιονοµική και διαρθρωτική πολιτική.

Περισσότερα

Friday, December 30, 2011

Europe's Dance of Death

by David Miles

Huffington Post

December 30, 2011

"It's a Ponzi scheme, it's a fraud, it's a sham," observed Jim Rogers this week when interviewed on the BBC World Service. One of the world's most successful investors was, however, not giving his verdict on the dastardly deeds which have confined Bernard Madoff to prison for 150 years, but rather the current strategy of the European Central Bank (ECB) and European leaders in trying to solve the euro zone sovereign debt crisis. For Rogers, their approach is based more on Peter Pan than sound monetary policy.

Ever since euro zone banks snapped up almost half a trillion euros in very low interest three-year loans offered by the ECB last week, the question was to what extent these banks would do the sovereigns a favour, as Nicholas Sarkozy hoped, by buying the bonds of euro zone governments. The answer, based on the results of Italy's latest bond auction on Thursday, is not encouraging. Investors are simply not prepared to lend money to Italy on a long-term basis without a cripplingly high premium, which at 6.98% is barely below the 7% level that forced Ireland, Greece and Portugal to request international bailouts.

If investors in government bonds seem a little nervous at the prospect of buying what until recently were seen as virtually risk-free financial assets, the reason for this reticence, as Jim Rogers observed, is not hard to discern. Money, as Harvard historian Niall Ferguson notes, is about trust and over the last two years the euro zone's political leaders have been extraordinarily successful at blowing every opportunity to solve the debt crisis and restore trust in the single currency project. When ordinary citizens can borrow money at less interest than the Italian state, then it's clear just how serious this crisis has become. For Anthony Crescenzi, executive vice president at Pimco, the largest bond fund in the world, European sovereign debt is "toxic" with about the same status that subprime mortgage assets have had ever since the financial crisis of 2008.

More

Huffington Post

December 30, 2011

"It's a Ponzi scheme, it's a fraud, it's a sham," observed Jim Rogers this week when interviewed on the BBC World Service. One of the world's most successful investors was, however, not giving his verdict on the dastardly deeds which have confined Bernard Madoff to prison for 150 years, but rather the current strategy of the European Central Bank (ECB) and European leaders in trying to solve the euro zone sovereign debt crisis. For Rogers, their approach is based more on Peter Pan than sound monetary policy.

Ever since euro zone banks snapped up almost half a trillion euros in very low interest three-year loans offered by the ECB last week, the question was to what extent these banks would do the sovereigns a favour, as Nicholas Sarkozy hoped, by buying the bonds of euro zone governments. The answer, based on the results of Italy's latest bond auction on Thursday, is not encouraging. Investors are simply not prepared to lend money to Italy on a long-term basis without a cripplingly high premium, which at 6.98% is barely below the 7% level that forced Ireland, Greece and Portugal to request international bailouts.

If investors in government bonds seem a little nervous at the prospect of buying what until recently were seen as virtually risk-free financial assets, the reason for this reticence, as Jim Rogers observed, is not hard to discern. Money, as Harvard historian Niall Ferguson notes, is about trust and over the last two years the euro zone's political leaders have been extraordinarily successful at blowing every opportunity to solve the debt crisis and restore trust in the single currency project. When ordinary citizens can borrow money at less interest than the Italian state, then it's clear just how serious this crisis has become. For Anthony Crescenzi, executive vice president at Pimco, the largest bond fund in the world, European sovereign debt is "toxic" with about the same status that subprime mortgage assets have had ever since the financial crisis of 2008.

More

The Lies that Europe's Politicians Tell Themselves

by Armin Mahler

Spiegel

December 30, 2011

Since its inception, the euro zone has been built on lies, the most grievous of which is the idea that the common currency could work without political union. But Europe's politicians are currently suffering under a different but equally fatal delusion -- that they have all the time in the world to fix the crisis.

How much does time cost? That depends what you need it for. The time that Europe's leaders want to buy to tackle the euro crisis is a precious commodity. And its price keeps going up and up.

Initially, it was supposed to cost €110 billion ($130 billion). That's how expensive the first EU bailout package for Greece was. Soon, it was expanded via a comprehensive rescue fund that helped out Portugal and Ireland. Then came a second bailout package for Greece, followed by an even more comprehensive rescue fund for the rest.

In late September 2011, representatives in Germany's parliament, the Bundestag, had not yet voted on this expanded package -- which would put Germany alone on the hook for €211 billion -- but it was already clear to them that even that wouldn't be enough. But nobody could say that out loud, and especially not Finance Minister Wolfgang Schäuble, because they obviously didn't want to endanger the government's majority in parliament -- and, thereby, its own ability to govern.

On top of that, the European Central Bank (ECB) is buying up sovereign bonds of debt-ridden euro-zone countries. At first, it was Greece, Portugal and Ireland. Then, beginning in the summer of 2011, it bought bonds from Italy and Spain. It now has a grand total of over €195 billion of bonds on its books. If things should go south, Germany will also ultimately be responsible for 27 percent of that figure, corresponding to Germany's share of the ECB's capital.

More

Spiegel

December 30, 2011

Since its inception, the euro zone has been built on lies, the most grievous of which is the idea that the common currency could work without political union. But Europe's politicians are currently suffering under a different but equally fatal delusion -- that they have all the time in the world to fix the crisis.

How much does time cost? That depends what you need it for. The time that Europe's leaders want to buy to tackle the euro crisis is a precious commodity. And its price keeps going up and up.

Initially, it was supposed to cost €110 billion ($130 billion). That's how expensive the first EU bailout package for Greece was. Soon, it was expanded via a comprehensive rescue fund that helped out Portugal and Ireland. Then came a second bailout package for Greece, followed by an even more comprehensive rescue fund for the rest.

In late September 2011, representatives in Germany's parliament, the Bundestag, had not yet voted on this expanded package -- which would put Germany alone on the hook for €211 billion -- but it was already clear to them that even that wouldn't be enough. But nobody could say that out loud, and especially not Finance Minister Wolfgang Schäuble, because they obviously didn't want to endanger the government's majority in parliament -- and, thereby, its own ability to govern.

On top of that, the European Central Bank (ECB) is buying up sovereign bonds of debt-ridden euro-zone countries. At first, it was Greece, Portugal and Ireland. Then, beginning in the summer of 2011, it bought bonds from Italy and Spain. It now has a grand total of over €195 billion of bonds on its books. If things should go south, Germany will also ultimately be responsible for 27 percent of that figure, corresponding to Germany's share of the ECB's capital.

More

Europe’s Market-Led Integration

by Joschka Fischer

Project Syndicate

December 30, 2011

For two years now, one European summit after another has ended with assurances that – at long last – the necessary measures for containing the eurozone’s sovereign-debt crisis have been taken. Most were publicly portrayed as breakthroughs, though they were nothing of the sort. As a rule, it took about three days before markets caught on and the crisis entered another round.

Because Europe’s political leaders have failed to manage the crisis effectively, the cost of ending it has risen. Indeed, an easily manageable financial crisis in Greece was allowed to grow into a life-threatening emergency for the states on the southern periphery of the European Union – and for the European project as a whole. This was statecraft at its worst, for which most of the blame can be laid at German Chancellor Angela Merkel’s door.

Indeed, prior to the European summit in Brussels in December, the stock of trust in the European Council had become so depleted that no one seemed to take its decisions seriously. Of course, it could be that the United Kingdom’s veto of the summit’s proposed changes to the EU’s Lisbon Treaty drowned out all else, while further increasing distrust on the part of the public and financial markets of a divided Europe.

More

Project Syndicate

December 30, 2011

For two years now, one European summit after another has ended with assurances that – at long last – the necessary measures for containing the eurozone’s sovereign-debt crisis have been taken. Most were publicly portrayed as breakthroughs, though they were nothing of the sort. As a rule, it took about three days before markets caught on and the crisis entered another round.

Because Europe’s political leaders have failed to manage the crisis effectively, the cost of ending it has risen. Indeed, an easily manageable financial crisis in Greece was allowed to grow into a life-threatening emergency for the states on the southern periphery of the European Union – and for the European project as a whole. This was statecraft at its worst, for which most of the blame can be laid at German Chancellor Angela Merkel’s door.

Indeed, prior to the European summit in Brussels in December, the stock of trust in the European Council had become so depleted that no one seemed to take its decisions seriously. Of course, it could be that the United Kingdom’s veto of the summit’s proposed changes to the EU’s Lisbon Treaty drowned out all else, while further increasing distrust on the part of the public and financial markets of a divided Europe.

More

Making a Voluntary Greek Debt Exchange Work

by G. Mitu Gulati and Jeromin Zettelmeyer

Duke Law School

December 30, 2011

Within the next few months, the Greek government, is supposed to persuade private creditors holding about EUR 200bn in its bonds to voluntarily exchange their existing bonds for new bonds that pay roughly 50 percent less. This may work with large creditors whose failure to participate in a debt exchange could trigger a Greek default, but may not persuade smaller creditors, who will be told that their claims will continue to be fully serviced if they do not participate in the exchange. This paper proposes an approach to dealing with this free rider problem that exploits the fact that with some probability, the proposed exchange might be followed by an involuntary restructuring some time in the future. The idea is to design the new bonds that creditors are offered in the exchange in a way that make them much harder to restructure than the current Greek government bonds. This is easy to do because the vast majority of outstanding Greek government bonds lack standard creditor protections. Hence, creditors would be offered a bond that performs much worse than their current bond if things go according to plan, but much better if things do not. They will accept this instrument if (1) the risk of a new Greek debt restructuring in the medium term is sufficiently high; (2) there is an expectation that the next restucturing probably will not be voluntary.

Within the next few months, the Greek government, is supposed to persuade private creditors holding about EUR 200bn in its bonds to voluntarily exchange their existing bonds for new bonds that pay roughly 50 percent less. This may work with large creditors whose failure to participate in a debt exchange could trigger a Greek default, but may not persuade smaller creditors, who will be told that their claims will continue to be fully serviced if they do not participate in the exchange. This paper proposes an approach to dealing with this free rider problem that exploits the fact that with some probability, the proposed exchange might be followed by an involuntary restructuring some time in the future. The idea is to design the new bonds that creditors are offered in the exchange in a way that make them much harder to restructure than the current Greek government bonds. This is easy to do because the vast majority of outstanding Greek government bonds lack standard creditor protections. Hence, creditors would be offered a bond that performs much worse than their current bond if things go according to plan, but much better if things do not. They will accept this instrument if (1) the risk of a new Greek debt restructuring in the medium term is sufficiently high; (2) there is an expectation that the next restucturing probably will not be voluntary.

Read the Paper

Duke Law School

December 30, 2011

Within the next few months, the Greek government, is supposed to persuade private creditors holding about EUR 200bn in its bonds to voluntarily exchange their existing bonds for new bonds that pay roughly 50 percent less. This may work with large creditors whose failure to participate in a debt exchange could trigger a Greek default, but may not persuade smaller creditors, who will be told that their claims will continue to be fully serviced if they do not participate in the exchange. This paper proposes an approach to dealing with this free rider problem that exploits the fact that with some probability, the proposed exchange might be followed by an involuntary restructuring some time in the future. The idea is to design the new bonds that creditors are offered in the exchange in a way that make them much harder to restructure than the current Greek government bonds. This is easy to do because the vast majority of outstanding Greek government bonds lack standard creditor protections. Hence, creditors would be offered a bond that performs much worse than their current bond if things go according to plan, but much better if things do not. They will accept this instrument if (1) the risk of a new Greek debt restructuring in the medium term is sufficiently high; (2) there is an expectation that the next restucturing probably will not be voluntary.

Within the next few months, the Greek government, is supposed to persuade private creditors holding about EUR 200bn in its bonds to voluntarily exchange their existing bonds for new bonds that pay roughly 50 percent less. This may work with large creditors whose failure to participate in a debt exchange could trigger a Greek default, but may not persuade smaller creditors, who will be told that their claims will continue to be fully serviced if they do not participate in the exchange. This paper proposes an approach to dealing with this free rider problem that exploits the fact that with some probability, the proposed exchange might be followed by an involuntary restructuring some time in the future. The idea is to design the new bonds that creditors are offered in the exchange in a way that make them much harder to restructure than the current Greek government bonds. This is easy to do because the vast majority of outstanding Greek government bonds lack standard creditor protections. Hence, creditors would be offered a bond that performs much worse than their current bond if things go according to plan, but much better if things do not. They will accept this instrument if (1) the risk of a new Greek debt restructuring in the medium term is sufficiently high; (2) there is an expectation that the next restucturing probably will not be voluntary.Read the Paper

Decline and fall of Greece’s Olympic legacy

Financial Times

December 30, 2012

In August 2004, the Galatsi Hall was the scene of table tennis rapture. South Korea’s Ryu Seung-min had just smashed a forehand to beat China’s Wang Hao and claim gold at the Athens Olympics. As Ryu leapt into his coach’s arms, the 6,500-seat facility roared.

Today Galatsi lies silent. A fence encircles the property and the main gate is padlocked. “Nobody’s been here in months,” says a security guard. “It hasn’t been used since the games.”

Galatsi’s fate is emblematic of an array of properties on which Greece spent billions of euros for the 2004 Olympics, which now mostly sit idle or underused.

Such facilities were once a source of national pride – the physical manifestation of a can-do spirit that allowed Greece to overcome doubters and construction delays to stage a well received games. Long after the closing ceremony they were supposed to yield further benefits, either by supporting local athletes or passing into the hands of private developers who could transform them into lucrative commercial properties.

But in a cautionary tale for other Olympic organisers – and a blow to Greece’s grand plan to sell off €50bn in state assets to reduce its crippling debts – many lie in various states of disuse, victims of legal squabbles, local corruption and poor planning.

More

December 30, 2012

In August 2004, the Galatsi Hall was the scene of table tennis rapture. South Korea’s Ryu Seung-min had just smashed a forehand to beat China’s Wang Hao and claim gold at the Athens Olympics. As Ryu leapt into his coach’s arms, the 6,500-seat facility roared.

Today Galatsi lies silent. A fence encircles the property and the main gate is padlocked. “Nobody’s been here in months,” says a security guard. “It hasn’t been used since the games.”

Galatsi’s fate is emblematic of an array of properties on which Greece spent billions of euros for the 2004 Olympics, which now mostly sit idle or underused.

Such facilities were once a source of national pride – the physical manifestation of a can-do spirit that allowed Greece to overcome doubters and construction delays to stage a well received games. Long after the closing ceremony they were supposed to yield further benefits, either by supporting local athletes or passing into the hands of private developers who could transform them into lucrative commercial properties.

But in a cautionary tale for other Olympic organisers – and a blow to Greece’s grand plan to sell off €50bn in state assets to reduce its crippling debts – many lie in various states of disuse, victims of legal squabbles, local corruption and poor planning.

More

Browne on Europe Debt Crisis, Global Economy

Bloomberg

December 30, 2011

John Browne, senior economic consultant at Euro Pacific Capital Inc., talks about the outlook for Europe's sovereign debt crisis in 2012 and its possible impact on the global economy. He speaks with Matt Miller on Bloomberg Television's "Bottom Line."

More

December 30, 2011

John Browne, senior economic consultant at Euro Pacific Capital Inc., talks about the outlook for Europe's sovereign debt crisis in 2012 and its possible impact on the global economy. He speaks with Matt Miller on Bloomberg Television's "Bottom Line."

More

Three big questions for the eurozone

by Paul Mason

BBC News

December 30, 2011

In a normal year predicting economics is like predicting the outcome of a card game: there are too many variables and the only certainty being that the suckers will lose and the stealthily self-interested will win.

In 2012 however, the shape of the crisis is heavily predetermined: there are a series of crucial stages the eurocrisis has to go through and the way they're resolved will affect everything else.

Starting from where we are now, there are three big questions:

More

BBC News

December 30, 2011

In a normal year predicting economics is like predicting the outcome of a card game: there are too many variables and the only certainty being that the suckers will lose and the stealthily self-interested will win.

In 2012 however, the shape of the crisis is heavily predetermined: there are a series of crucial stages the eurocrisis has to go through and the way they're resolved will affect everything else.

Starting from where we are now, there are three big questions:

- Is the ECB's unofficial money printing operation - a massively expanded bond-buying venture combined with unlimited provision of cash by global central banks - going to be enough to prevent a second credit crunch, centred on Italy?

- Does Greece spiral finally into default, social crisis and chaos, raising the prospect of the near-dictatorial economic policies needed if you have to exit the Euro?

- Do the French banks take so many losses on the sovereign debt of southern Europe that they have to be part nationalised, thus removing the country's AAA credit rating and the all-important financial parity between Germany and France that lies at the heart of the European system?

More

The Eurozone Crisis For Dummies

by Simone Foxman

Business Insider

December 30, 2011

The market still seems to be moving to every headline out of the eurozone, but it's hard to remember what's important.

So let's bring this back into perspective.

A little background:

More

Business Insider

December 30, 2011

The market still seems to be moving to every headline out of the eurozone, but it's hard to remember what's important.

So let's bring this back into perspective.

A little background:

- Since joining the euro back in 1999, the governments of Greece and Portugal (among other offenders) have gotten used to spending a LOT of money. When times were good, it wasn't a problem — banks and other investors were willing to lend them money on the cheap and their public sectors became bloated.

- When the financial crisis hit, however, problems came to a head. Debt levels in Portugal, Italy, and Greece became unsustainable, and taxes in a contracting economy are no longer enough to pay the bills.

- Greece, Portugal, and Ireland are still struggling to bring their public debt under control, after receiving billions of euros in bailout aid from the European Commission, the International Monetary Fund, and the European Central Bank (the so-called troika). Some of this aid was provided through a temporary Special Purpose Vehicle called the European Financial Stability Facility (EFSF).

- These governments needed this money because it became too expensive for them to borrow cash on the open markets, with speculators demanding high rates for lending and traders even betting on a disorderly sovereign default.

- The initial round of aid money helped these governments prop up their banks and pay their bills.

- The ECB also started buying government bonds on the secondary market in order to keep borrowing costs low.

- But now Greece needs more dough to stay solvent. EU leaders agreed back in July that a "selective default" was the only option for Greece. Under this situation, euro area nations will guarantee payouts on Greek sovereign debt, but the private sector will bear take a loss — a "haircut" — on their debt holdings, reducing the face value of those holdings.

- Italy and Spain are now crucial to the debate. The former has an incredible level of public debt (120% in 2010) and the latter has been crushed by a housing bubble and subsequent banking crisis.

- The July agreement also expanded the EFSF to €440 billion and allowed the ECB to purchase Spanish and Italian government bonds.

More

A Voluntary Greek Debt Deal?

by Matina Stevis

Wall Street Journal

December 30, 2011

Many analysts have been pessimistic about the likely success of efforts to lower Greece’s debt burden by restructuring its government bonds.

But a new paper by financial-law academic Mitu Gulati and Jeromin Zettelmeyer of the European Bank for Reconstruction and Development, published today, puts a, sort of, positive spin on the gloom over Greek “private sector involvement” or PSI.

Messrs. Gulati and Zettelmeyer build an elegant model that calculates what it will take for private creditors to participate voluntarily in the Greek restructuring deal and therefore make PSI a success.

The two conclude that success is within reach if creditors perceive a 50% or higher probability that Greece will be forced into or opt for another debt restructuring in the medium-run. That second restructuring would probably not be voluntary.

More

Wall Street Journal

December 30, 2011

Many analysts have been pessimistic about the likely success of efforts to lower Greece’s debt burden by restructuring its government bonds.

But a new paper by financial-law academic Mitu Gulati and Jeromin Zettelmeyer of the European Bank for Reconstruction and Development, published today, puts a, sort of, positive spin on the gloom over Greek “private sector involvement” or PSI.

Messrs. Gulati and Zettelmeyer build an elegant model that calculates what it will take for private creditors to participate voluntarily in the Greek restructuring deal and therefore make PSI a success.

The two conclude that success is within reach if creditors perceive a 50% or higher probability that Greece will be forced into or opt for another debt restructuring in the medium-run. That second restructuring would probably not be voluntary.

More

IMF Warned Greece on Debt Levels

Wall Street Journal

December 30, 2011

The International Monetary Fund recently told the Greek government that a worsening economic outlook suggests the beleaguered nation may be unable to reduce its debt to sustainable levels even with a planned 50% write down in privately-held Greek government bonds, according to two officials familiar with the conversations.

"A 50% haircut may no longer be enough" to bring Greece's debt to sustainable levels given the new IMF economic forecasts, said one of the officials.

An official at the IMF confirmed staff are working on starker economic assessment than outlined last month in its loan-program review for the country. Some IMF officials think "the debt sustainability analysis is not valid anymore" under the new economic forecasts, the official said. For Greece's debt to be sustainable now "requires either a deeper haircut or additional loans from Europe," he said.

The comments underscore the fragility of Greece's finances and speculation in markets that it is heading towards a default on its debt.

More

December 30, 2011

The International Monetary Fund recently told the Greek government that a worsening economic outlook suggests the beleaguered nation may be unable to reduce its debt to sustainable levels even with a planned 50% write down in privately-held Greek government bonds, according to two officials familiar with the conversations.

"A 50% haircut may no longer be enough" to bring Greece's debt to sustainable levels given the new IMF economic forecasts, said one of the officials.

An official at the IMF confirmed staff are working on starker economic assessment than outlined last month in its loan-program review for the country. Some IMF officials think "the debt sustainability analysis is not valid anymore" under the new economic forecasts, the official said. For Greece's debt to be sustainable now "requires either a deeper haircut or additional loans from Europe," he said.

The comments underscore the fragility of Greece's finances and speculation in markets that it is heading towards a default on its debt.

More

Europe's Leaders May Need History Lesson

by Stephen Fidler

Wall Street Journal

December 30, 2011

Given their record to date, is there any reason for faith that Europe's leaders will succeed in 2012 in doing what they signally failed to do in 2011 and stem the crisis that now threatens the existence of the euro zone?

The auguries aren't good. The culmination of their work over the year, as the Journal's reconstructions published over the past two days have shown, is to have guided a debt crisis in three small economies into a survival struggle for the single currency.

Many of those players have already left the political stage: Brian Cowen, José Sócrates, George Papandreou, José Luis Rodríguez Zapatero, Silvio Berlusconi.

Technocrats rule troublesome Greece and Italy, and governments with new mandates have taken over in Spain, Ireland and Portugal. But pessimism over the future of the euro and the ability of governments to boss events appears close to an all-time high.

As this column pointed out last week, the leaders' muddling-through isn't yet doomed to failure. And perhaps we whose job it is to attend on serial summits and ministerial meetings invest them with too much significance.

More

Wall Street Journal

December 30, 2011

Given their record to date, is there any reason for faith that Europe's leaders will succeed in 2012 in doing what they signally failed to do in 2011 and stem the crisis that now threatens the existence of the euro zone?

The auguries aren't good. The culmination of their work over the year, as the Journal's reconstructions published over the past two days have shown, is to have guided a debt crisis in three small economies into a survival struggle for the single currency.

Many of those players have already left the political stage: Brian Cowen, José Sócrates, George Papandreou, José Luis Rodríguez Zapatero, Silvio Berlusconi.

Technocrats rule troublesome Greece and Italy, and governments with new mandates have taken over in Spain, Ireland and Portugal. But pessimism over the future of the euro and the ability of governments to boss events appears close to an all-time high.

As this column pointed out last week, the leaders' muddling-through isn't yet doomed to failure. And perhaps we whose job it is to attend on serial summits and ministerial meetings invest them with too much significance.

More

Deepening Crisis Over Euro Pits Leader Against Leader

Wall Street Journal

December 30, 2011

On a chilly October evening in her austere chancellery, Angela Merkel placed a confidential call to Rome to help save the euro.

Two years after the European debt crisis erupted in little Greece, the unthinkable had happened: Investors were fleeing the government debt of Italy—one of the world's biggest economies. If the selloff couldn't be stopped, Italy would go down, taking with it Europe's shared currency.

Her phone call that night to the 16th-century Quirinale Palace, once a residence of popes, now home to Italy's octogenarian head of state, President Giorgio Napolitano, trod on delicate ground for a German chancellor. Europe's leaders have an unwritten rule not to intervene in one another's domestic politics. But Ms. Merkel was gently prodding Italy to change its prime minister, if the incumbent—Silvio Berlusconi—couldn't change Italy.

Details of Ms. Merkel's diplomatic channel to Rome haven't previously been reported.

Her impatience shows the extent to which Italy's woes undid Europe's strategy to fight the crisis. Until then, Europe had followed a simple formula to preserve the euro: The financially strong would save the weak. But Italy, with nearly €2 trillion, or about $2.6 trillion, in national debt, was simply too big to save.

This Wall Street Journal reconstruction, based on interviews with more than two dozen policy makers, including many leading actors, as well as examinations of key documents, reveals how Germany responded to the dangers in Italy by imposing its power on a divided euro zone. Ms. Merkel, widely criticized for not dealing forcefully with the crisis in its early phase, was at the center of the action, grappling with personal tensions and Byzantine politics among the 17 euro nations.

More

December 30, 2011

On a chilly October evening in her austere chancellery, Angela Merkel placed a confidential call to Rome to help save the euro.

Two years after the European debt crisis erupted in little Greece, the unthinkable had happened: Investors were fleeing the government debt of Italy—one of the world's biggest economies. If the selloff couldn't be stopped, Italy would go down, taking with it Europe's shared currency.

Her phone call that night to the 16th-century Quirinale Palace, once a residence of popes, now home to Italy's octogenarian head of state, President Giorgio Napolitano, trod on delicate ground for a German chancellor. Europe's leaders have an unwritten rule not to intervene in one another's domestic politics. But Ms. Merkel was gently prodding Italy to change its prime minister, if the incumbent—Silvio Berlusconi—couldn't change Italy.

Details of Ms. Merkel's diplomatic channel to Rome haven't previously been reported.

Her impatience shows the extent to which Italy's woes undid Europe's strategy to fight the crisis. Until then, Europe had followed a simple formula to preserve the euro: The financially strong would save the weak. But Italy, with nearly €2 trillion, or about $2.6 trillion, in national debt, was simply too big to save.

This Wall Street Journal reconstruction, based on interviews with more than two dozen policy makers, including many leading actors, as well as examinations of key documents, reveals how Germany responded to the dangers in Italy by imposing its power on a divided euro zone. Ms. Merkel, widely criticized for not dealing forcefully with the crisis in its early phase, was at the center of the action, grappling with personal tensions and Byzantine politics among the 17 euro nations.

More

Thursday, December 29, 2011

Our age of mounting indignation

by Gideon Rachman

Financial Times

December 29, 2011

It has been many centuries since the Mediterranean Sea was the centre of civilisation. But in 2011 the Med was back – not just as a holiday destination – but at the very centre of world affairs. This was a year of global indignation, from the Occupy Wall Street movement to the Moscow election protests and China’s village revolts. It was popular protests on either side of the Mediterranean – in Tahrir Square in Cairo and Syntagma Square in Athens – that set the tone for 2011.

Revolutions in Egypt and Tunisia at the beginning of the year sparked off the Arab spring, a political earthquake whose after-shocks were felt as far afield as Moscow and Beijing. On the other side of Mare Nostrum, Europe’s sovereign debt crisis spread from riotous Greece to Portugal, and then to Italy and Spain. By the end of the year, the fate of the world economy seemed to hang on the ability of southern Europe to service its debts.

For that reason this column – devoted to my annual list of the five most important events of year – has to begin with the Arab spring and Europe’s debt crisis: regional crises with global implications. Both events brought crowds on to the streets. But the Arab uprisings were also marked by bloodshed and warfare. Even the relatively peaceful transition in Egypt cost some 800 lives, while Muammer Gaddafi in Libya was only deposed (and ultimately murdered) after a full insurrection, backed by western air power.

However, while the costs of the Arab spring were far higher, it, at least, was driven by a faith that the future could be better. Europe’s debt crisis, by contrast, was characterised by fear of the future. The revolutions in Egypt and Tunisia gave many ordinary people a heady sense that, at last, they had the chance to take control of their own destiny, while Europe’s debt problems left most citizens feeling they were at the mercy of economic forces that they could not control.

More

Financial Times

December 29, 2011

It has been many centuries since the Mediterranean Sea was the centre of civilisation. But in 2011 the Med was back – not just as a holiday destination – but at the very centre of world affairs. This was a year of global indignation, from the Occupy Wall Street movement to the Moscow election protests and China’s village revolts. It was popular protests on either side of the Mediterranean – in Tahrir Square in Cairo and Syntagma Square in Athens – that set the tone for 2011.

Revolutions in Egypt and Tunisia at the beginning of the year sparked off the Arab spring, a political earthquake whose after-shocks were felt as far afield as Moscow and Beijing. On the other side of Mare Nostrum, Europe’s sovereign debt crisis spread from riotous Greece to Portugal, and then to Italy and Spain. By the end of the year, the fate of the world economy seemed to hang on the ability of southern Europe to service its debts.

For that reason this column – devoted to my annual list of the five most important events of year – has to begin with the Arab spring and Europe’s debt crisis: regional crises with global implications. Both events brought crowds on to the streets. But the Arab uprisings were also marked by bloodshed and warfare. Even the relatively peaceful transition in Egypt cost some 800 lives, while Muammer Gaddafi in Libya was only deposed (and ultimately murdered) after a full insurrection, backed by western air power.

However, while the costs of the Arab spring were far higher, it, at least, was driven by a faith that the future could be better. Europe’s debt crisis, by contrast, was characterised by fear of the future. The revolutions in Egypt and Tunisia gave many ordinary people a heady sense that, at last, they had the chance to take control of their own destiny, while Europe’s debt problems left most citizens feeling they were at the mercy of economic forces that they could not control.

More

Two Models for Europe

by Hans-Werner Sinn

Project Syndicate

December 29, 2011

Interest rates for public debt within the eurozone have spread once again, just as they did before the introduction of the euro. Balance-of-payment disparities are steadily increasing. The sovereign-debt crisis is eating its way from the periphery to the core, and the exodus of capital is accelerating. Since the summer, €300 billion, in net terms, may well have fled from Italy and France.

The printing presses at the Banque de France and the Banca d’Italia are working overtime to make up for the outflow of money. But this only furthers the exodus, because creating more money prevents interest rates from rising to a point at which capital would find it attractive to stay.

If Europe had the same rules as the United States, where the Federal Reserve’s regional banks have to pay the Fed for any special money creation with securities collateralized in gold, they would not create this much supplementary money, and capital flight would be limited. Instead, local printing of money is essentially aiding and abetting the exodus.

If the eurozone does not want to embrace capital controls, it has only two alternatives: make the local printing of money more difficult, or offer investment guarantees in countries that markets view as insecure.

The first option is the American way, which also demands that the buyers bear the risks inherent in public or private securities. The taxpayer is not called upon, even in extreme cases, and states can go bankrupt.

The second option is the socialist way. Investment guarantees will lead, via issuance of Eurobonds, to socialization of the risks inherent in public debt. Because all the member states provide one another with free credit guarantees, interest rates for government securities can no longer differ in accordance with creditworthiness or likelihood of repayment. The less sound a country is, the lower its effective expected interest rate.

More

Project Syndicate

December 29, 2011

Interest rates for public debt within the eurozone have spread once again, just as they did before the introduction of the euro. Balance-of-payment disparities are steadily increasing. The sovereign-debt crisis is eating its way from the periphery to the core, and the exodus of capital is accelerating. Since the summer, €300 billion, in net terms, may well have fled from Italy and France.

The printing presses at the Banque de France and the Banca d’Italia are working overtime to make up for the outflow of money. But this only furthers the exodus, because creating more money prevents interest rates from rising to a point at which capital would find it attractive to stay.

If Europe had the same rules as the United States, where the Federal Reserve’s regional banks have to pay the Fed for any special money creation with securities collateralized in gold, they would not create this much supplementary money, and capital flight would be limited. Instead, local printing of money is essentially aiding and abetting the exodus.

If the eurozone does not want to embrace capital controls, it has only two alternatives: make the local printing of money more difficult, or offer investment guarantees in countries that markets view as insecure.

The first option is the American way, which also demands that the buyers bear the risks inherent in public or private securities. The taxpayer is not called upon, even in extreme cases, and states can go bankrupt.

The second option is the socialist way. Investment guarantees will lead, via issuance of Eurobonds, to socialization of the risks inherent in public debt. Because all the member states provide one another with free credit guarantees, interest rates for government securities can no longer differ in accordance with creditworthiness or likelihood of repayment. The less sound a country is, the lower its effective expected interest rate.

More

Greek bond swap deal may soon be reached

Reuters

December 29, 2011

Greece could soon reach a deal with banks and private creditors on a bond swap to reduce its mountain of debt, the government spokesman said on Thursday, as it tries to resolve differences with its creditors and avoid default.

The deal is a pivotal part of a second, 130 billion euro ($168.3 billion) bailout package for Athens agreed by euro zone leaders in October. Greece, which faces bond redemptions of 14.5 billion euros in March, needs to seal the deal to avert a costly default.

"I think there will be an agreement relatively soon. I don't think there will be a problem with this deal," government spokesman Pantelis Kapsis told Real News radio.

"Apart from that, (the issue is) how many (bondholders) will participate, which will be seen at the end of next month or in early February," he said.

More

December 29, 2011

Greece could soon reach a deal with banks and private creditors on a bond swap to reduce its mountain of debt, the government spokesman said on Thursday, as it tries to resolve differences with its creditors and avoid default.

The deal is a pivotal part of a second, 130 billion euro ($168.3 billion) bailout package for Athens agreed by euro zone leaders in October. Greece, which faces bond redemptions of 14.5 billion euros in March, needs to seal the deal to avert a costly default.

"I think there will be an agreement relatively soon. I don't think there will be a problem with this deal," government spokesman Pantelis Kapsis told Real News radio.

"Apart from that, (the issue is) how many (bondholders) will participate, which will be seen at the end of next month or in early February," he said.

More

Euro break-up

Financial Times

December 29, 2011

Once upon a time, conversations about Italy centred on football or holidays in Tuscany. That changed in 2011. Suddenly, all anyone could talk about was Italy’s 10-year bond yields (around 7 per cent, since you ask). This reflects a rather complacent bit of received wisdom – that such high borrowing costs are not sustainable, that Italy will soon not be able to afford them and will have to default on its €1.9tn of sovereign debt, and that this is the event that will destroy the eurozone.

It is true that if Italy fails, the eurozone fails. The biggest threat Rome faces, in fact, is not that its debt becomes unaffordable but that investors stop buying it at any price. Yet the corollary – that if Italy is saved the eurozone is saved – is not true. The bloc’s structural flaws will remain. In particular, the virus that the eurozone has incubated from birth – Greece – will still be in its bloodstream. The eurozone will not be saved until it finally sorts out the Greek mess. The only way to do that is for Greece to leave.

The eurozone’s financial crisis has endured because policymakers have refused to acknowledge this. That stance began to shift in 2011 during the events that led to the collapse of George Papandreou’s government. Yet it remains the most important unaddressed question now facing eurozone policymakers, who should consider a Greek exit as a policy option rather than a taboo. Every attempt to bail out Greece is failing, and each exercise just increases the debt burden while shrinking the economy and its ability to repay.

More

December 29, 2011

Once upon a time, conversations about Italy centred on football or holidays in Tuscany. That changed in 2011. Suddenly, all anyone could talk about was Italy’s 10-year bond yields (around 7 per cent, since you ask). This reflects a rather complacent bit of received wisdom – that such high borrowing costs are not sustainable, that Italy will soon not be able to afford them and will have to default on its €1.9tn of sovereign debt, and that this is the event that will destroy the eurozone.

It is true that if Italy fails, the eurozone fails. The biggest threat Rome faces, in fact, is not that its debt becomes unaffordable but that investors stop buying it at any price. Yet the corollary – that if Italy is saved the eurozone is saved – is not true. The bloc’s structural flaws will remain. In particular, the virus that the eurozone has incubated from birth – Greece – will still be in its bloodstream. The eurozone will not be saved until it finally sorts out the Greek mess. The only way to do that is for Greece to leave.

The eurozone’s financial crisis has endured because policymakers have refused to acknowledge this. That stance began to shift in 2011 during the events that led to the collapse of George Papandreou’s government. Yet it remains the most important unaddressed question now facing eurozone policymakers, who should consider a Greek exit as a policy option rather than a taboo. Every attempt to bail out Greece is failing, and each exercise just increases the debt burden while shrinking the economy and its ability to repay.

More

It’s time for the IMF to stand up to the European bullies

by Mohamed El-Erian

Financial Times

December 29, 2011

Sovereign risk was a principal theme in 2011 – most visibly in Europe and, to a lesser extent, in America’s loss of its triple A rating. Along with poor growth and rising inequality, it will continue to raise serious questions next year about the functioning of the global economy. As this occurs, one institution – the International Monetary Fund – will attract special attention. The key question is whether it can finally step up to the role of global conductor, rather than suffering yet more erosion of its credibility.

The sovereign risk crisis has not been kind to the IMF, especially when it comes to Europe. There is no denying that too many of the adjustment programmes it has overseen have fallen short of their objectives. Whether it jumped or was pushed, the institution sacrificed some of its own rules, including those previously deemed sacrosanct.

For two years, the IMF agreed to a series of programmes that were partially designed, inadequately funded and, in some cases, even threatened its preferred creditor status. In each case, the IMF ended up supporting an weak attempt to muddle through, rather than a plan sustainable in the medium term.

This shortfall has accentuated prior concerns about the IMF’s governance, representation and legitimacy. The damage has been material, though fortunately not irreversible.

More

Financial Times

December 29, 2011

Sovereign risk was a principal theme in 2011 – most visibly in Europe and, to a lesser extent, in America’s loss of its triple A rating. Along with poor growth and rising inequality, it will continue to raise serious questions next year about the functioning of the global economy. As this occurs, one institution – the International Monetary Fund – will attract special attention. The key question is whether it can finally step up to the role of global conductor, rather than suffering yet more erosion of its credibility.

The sovereign risk crisis has not been kind to the IMF, especially when it comes to Europe. There is no denying that too many of the adjustment programmes it has overseen have fallen short of their objectives. Whether it jumped or was pushed, the institution sacrificed some of its own rules, including those previously deemed sacrosanct.

For two years, the IMF agreed to a series of programmes that were partially designed, inadequately funded and, in some cases, even threatened its preferred creditor status. In each case, the IMF ended up supporting an weak attempt to muddle through, rather than a plan sustainable in the medium term.

This shortfall has accentuated prior concerns about the IMF’s governance, representation and legitimacy. The damage has been material, though fortunately not irreversible.

More

European Fiscal Zombies

by Paul Krugman

New York Times

December 29, 2011

Dean Baker is unhappy at seeing yet another article asserting as fact something that is actually just something fiscal hawks imagine: the claim that Europe’s problem economies were running up government debt before the crisis.

Dean, this is a zombie; you can’t kill it unless you shoot it in the head.

Maybe the problem is that when Dean and I try to point out that Spain and Ireland don’t look anything like Greece, that’s just too complicated. So here’s another attempt: let’s construct an “average” troubled European government. I take debt to GDP from the IMF debt database, and weight the five GIPSI countries by their GDP in 2007. Here’s what I get:

More

New York Times

December 29, 2011

Dean Baker is unhappy at seeing yet another article asserting as fact something that is actually just something fiscal hawks imagine: the claim that Europe’s problem economies were running up government debt before the crisis.

Dean, this is a zombie; you can’t kill it unless you shoot it in the head.

Maybe the problem is that when Dean and I try to point out that Spain and Ireland don’t look anything like Greece, that’s just too complicated. So here’s another attempt: let’s construct an “average” troubled European government. I take debt to GDP from the IMF debt database, and weight the five GIPSI countries by their GDP in 2007. Here’s what I get:

More

Greek Tax Officials Strike

Wall Street Journal

December 29, 2011

Greek tax officials began a 48-hour walkout Thursday to protest wage cuts and other changes imposed by the government as Greece struggles to meet revenue targets it has promised international creditors.

The strike closed tax offices around the country on the last two working days of the year, and forced the government to extend deadlines for the payment of some year-end taxes.

Greece is now in the second year of an austerity drive aimed at closing a yawning budget gap that has forced it to seek official aid from its European partners and the International Monetary Fund.

It has introduced a range of new taxes and deep spending cuts. But lagging tax collections have forced the government to admit it will miss its deficit targets this year, with a budget gap expected to be 9% of gross domestic product, or €19.68 billion.

More

December 29, 2011

Greek tax officials began a 48-hour walkout Thursday to protest wage cuts and other changes imposed by the government as Greece struggles to meet revenue targets it has promised international creditors.

The strike closed tax offices around the country on the last two working days of the year, and forced the government to extend deadlines for the payment of some year-end taxes.

Greece is now in the second year of an austerity drive aimed at closing a yawning budget gap that has forced it to seek official aid from its European partners and the International Monetary Fund.

It has introduced a range of new taxes and deep spending cuts. But lagging tax collections have forced the government to admit it will miss its deficit targets this year, with a budget gap expected to be 9% of gross domestic product, or €19.68 billion.

More

Greece must not leave asylum seekers at the mercy of extremists

by Hans Lucht

Guardian

December 29, 2011

On the morning of 25 May, Kelly from Ghana was on the bus going to a pickup place at the outskirts of Athens, where African immigrants and asylum seekers go to look for work, when he was attacked by a mob. He saw them from afar, standing at the bus stop – a group of about 10 young men – but thought nothing of it. They were probably going to one of the demonstrations, he supposed. But as they entered the bus, they pulled out bats, iron rods and knives, and attacked him.

As Greece struggles to avoid economic meltdown, dark-skinned immigrants and asylum seekers have become scapegoats in racially motivated attacks that, according to the United Nations high commissioner for refugees, have become an almost daily occurrence in Athens.

Last week, in cases pertaining to asylum seekers caught entering the UK and Ireland, the European court of justice upheld that asylum seekers could not be sent back to Greece because they risk being subjected to "inhuman or degrading treatment".

Ninety per cent of undocumented immigrants enter the EU via Greece. The Greek response has been to announce the construction of a barbed wire wall on the Turkish border, though the EU has made clear that such a wall will receive no funding. The influx of migrants has not been welcomed by some segments of the Greek population. Thus the extreme rightwing party Golden Dawn won its first ever seat on the Athens city council in November 2010 on an anti-immigrant agenda.

More

Guardian

December 29, 2011

On the morning of 25 May, Kelly from Ghana was on the bus going to a pickup place at the outskirts of Athens, where African immigrants and asylum seekers go to look for work, when he was attacked by a mob. He saw them from afar, standing at the bus stop – a group of about 10 young men – but thought nothing of it. They were probably going to one of the demonstrations, he supposed. But as they entered the bus, they pulled out bats, iron rods and knives, and attacked him.

As Greece struggles to avoid economic meltdown, dark-skinned immigrants and asylum seekers have become scapegoats in racially motivated attacks that, according to the United Nations high commissioner for refugees, have become an almost daily occurrence in Athens.

Last week, in cases pertaining to asylum seekers caught entering the UK and Ireland, the European court of justice upheld that asylum seekers could not be sent back to Greece because they risk being subjected to "inhuman or degrading treatment".

Ninety per cent of undocumented immigrants enter the EU via Greece. The Greek response has been to announce the construction of a barbed wire wall on the Turkish border, though the EU has made clear that such a wall will receive no funding. The influx of migrants has not been welcomed by some segments of the Greek population. Thus the extreme rightwing party Golden Dawn won its first ever seat on the Athens city council in November 2010 on an anti-immigrant agenda.

More

Dithering at the Top Turned EU Crisis to Global Threat

Wall Street Journal

December 29, 2011

At a closed-door meeting in Washington on April 14, Europe's effort to contain its debt crisis began to unravel.

Inside the French ambassador's 19-bedroom mansion, finance ministers and central bankers from the world's largest economies heard Dominique Strauss-Kahn, then-head of the International Monetary Fund, deliver an ultimatum.

Greece, the country that triggered the euro-zone debt crisis, would need a much bigger bailout than planned, Mr. Strauss-Kahn said. Unless Europe coughed up extra cash, the IMF, which a year earlier had agreed to share the burden with European countries, wouldn't release any more aid for Athens.

The warning prompted a split among the euro zone's representatives over who should pay to save Greece from the biggest sovereign bankruptcy in history. European taxpayers alone? Or should the banks that had lent Greece too much during the global credit bubble also suffer?

The IMF didn't mind how Europe proceeded, as long as there was clarity by summer. "We need a decision," said Mr. Strauss-Kahn.

It was to be Europe's fateful spring. A Wall Street Journal investigation, based on more than two dozen interviews with euro-zone policy makers, revealed how the currency union floundered in indecision—failing to address either the immediate concerns of investors or the fundamental weaknesses undermining the euro. The consequence was that a crisis in a few small economies turned into a threat to the survival of Europe's common currency and a menace to the global economy.

More

December 29, 2011

At a closed-door meeting in Washington on April 14, Europe's effort to contain its debt crisis began to unravel.

Inside the French ambassador's 19-bedroom mansion, finance ministers and central bankers from the world's largest economies heard Dominique Strauss-Kahn, then-head of the International Monetary Fund, deliver an ultimatum.

Greece, the country that triggered the euro-zone debt crisis, would need a much bigger bailout than planned, Mr. Strauss-Kahn said. Unless Europe coughed up extra cash, the IMF, which a year earlier had agreed to share the burden with European countries, wouldn't release any more aid for Athens.

The warning prompted a split among the euro zone's representatives over who should pay to save Greece from the biggest sovereign bankruptcy in history. European taxpayers alone? Or should the banks that had lent Greece too much during the global credit bubble also suffer?

The IMF didn't mind how Europe proceeded, as long as there was clarity by summer. "We need a decision," said Mr. Strauss-Kahn.

It was to be Europe's fateful spring. A Wall Street Journal investigation, based on more than two dozen interviews with euro-zone policy makers, revealed how the currency union floundered in indecision—failing to address either the immediate concerns of investors or the fundamental weaknesses undermining the euro. The consequence was that a crisis in a few small economies turned into a threat to the survival of Europe's common currency and a menace to the global economy.

More

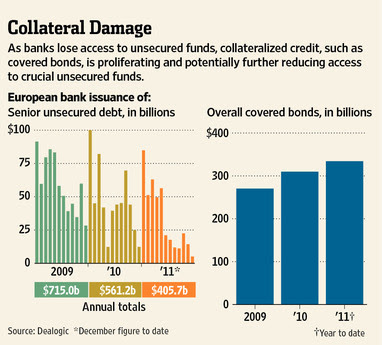

Europe's Banks Face Pressure on Collateral

Wall Street Journal

December 29, 2011

Even after the European Central Bank doled out nearly half a trillion euros of loans to cash-strapped banks last week, fears about potential financial problems are still stalking the sector. One big reason: concerns about collateral.

The only way European banks can now convince anyone—institutional investors, fellow banks or the ECB—to lend them money is if they pledge high-quality assets as collateral.

Now some regulators and bankers are becoming nervous that some lenders' supplies of such assets, which include European government bonds and investment-grade non-government debt, are running low.

If banks exhaust their stockpiles of assets that are eligible to serve as collateral, they could encounter liquidity problems. That is what happened this past fall to Franco-Belgian lender Dexia SA, which ran out of money and required a government bailout.

More

December 29, 2011

Even after the European Central Bank doled out nearly half a trillion euros of loans to cash-strapped banks last week, fears about potential financial problems are still stalking the sector. One big reason: concerns about collateral.

The only way European banks can now convince anyone—institutional investors, fellow banks or the ECB—to lend them money is if they pledge high-quality assets as collateral.

Now some regulators and bankers are becoming nervous that some lenders' supplies of such assets, which include European government bonds and investment-grade non-government debt, are running low.

If banks exhaust their stockpiles of assets that are eligible to serve as collateral, they could encounter liquidity problems. That is what happened this past fall to Franco-Belgian lender Dexia SA, which ran out of money and required a government bailout.

More

TF's Tchir on Europe Sovereign Debt Crisis

Bloomberg

December 28, 2011

Peter Tchir, founder of TF Market Advisors, talks about Europe's sovereign debt crisis and the possibility that Greece will default on its debt. He speaks with Adam Johnson on Bloomberg Television's "Street Smart."

More

December 28, 2011

Peter Tchir, founder of TF Market Advisors, talks about Europe's sovereign debt crisis and the possibility that Greece will default on its debt. He speaks with Adam Johnson on Bloomberg Television's "Street Smart."

More

Wednesday, December 28, 2011

Grim lessons from the 30 years war

by Wolfgang Münchau

Financial Times

December 28, 2011

The financial crisis has given rise to several historical comparisons, not least the Great Depression. I would like to invoke another for the eurozone crisis – the 30 years war, which ravaged central Europe from 1618 to 1648.

Both the eurozone crisis and that terrible war occurred amid sudden power shifts; they were triggered by seemly trivial events; and they became incredibly complicated. They are also marked by sudden regional power shifts. Before 1618, the Holy Roman Empire was almost equally divided into Catholic and Protestant electorates. The truce ended when the balance of power shifted with the ascension in 1617 of the Catholic Ferdinand as king of Bohemia, who was one of the seven electors of the emperor. The actual war started a year later when rebels threw some of the king’s advisers out of a window. The famous defenestration of Prague triggered the first battles of a war between Protestants and Catholics, which went completely out of control. The war had four phases, and drew in outside nations – the Danes, the Swedes and finally the French.

The eurozone, too, has been subject to an internal power shift in the past five years, with the relative rise of German economic power. The eurozone crisis also had a comparatively trivial trigger, a fiscal meltdown of a small country at its outer perimeter. This too unleashed a wider economic conflict between a largely Protestant north and a Catholic/Orthodox south. When the eurozone’s modern rulers assembled in Brussels this month to sign the modern equivalent of a peace treaty, they were interrupted by the cross-current of a much older conflict – a UK-versus-the-rest dispute. So instead of one peace treaty, they ended up with two overlapping and interacting conflicts. Europe is once again getting absurdly complicated.

More

Financial Times

December 28, 2011

The financial crisis has given rise to several historical comparisons, not least the Great Depression. I would like to invoke another for the eurozone crisis – the 30 years war, which ravaged central Europe from 1618 to 1648.

Both the eurozone crisis and that terrible war occurred amid sudden power shifts; they were triggered by seemly trivial events; and they became incredibly complicated. They are also marked by sudden regional power shifts. Before 1618, the Holy Roman Empire was almost equally divided into Catholic and Protestant electorates. The truce ended when the balance of power shifted with the ascension in 1617 of the Catholic Ferdinand as king of Bohemia, who was one of the seven electors of the emperor. The actual war started a year later when rebels threw some of the king’s advisers out of a window. The famous defenestration of Prague triggered the first battles of a war between Protestants and Catholics, which went completely out of control. The war had four phases, and drew in outside nations – the Danes, the Swedes and finally the French.

The eurozone, too, has been subject to an internal power shift in the past five years, with the relative rise of German economic power. The eurozone crisis also had a comparatively trivial trigger, a fiscal meltdown of a small country at its outer perimeter. This too unleashed a wider economic conflict between a largely Protestant north and a Catholic/Orthodox south. When the eurozone’s modern rulers assembled in Brussels this month to sign the modern equivalent of a peace treaty, they were interrupted by the cross-current of a much older conflict – a UK-versus-the-rest dispute. So instead of one peace treaty, they ended up with two overlapping and interacting conflicts. Europe is once again getting absurdly complicated.

More

What has the ECB done in the crisis? The role of TARGET balances

by Martin Wolf

Financial Times

December 28, 2011

Will the European Central Bank save the eurozone? This is an extremely controversial question. What is clear, however, is that the central bank is the only entity with the capacity and the calling to do so. Without the euro, the ECB ceases to exist. That is true of no other eurozone institution. It gives it the incentive to act. It is also acting on a large scale.

The resistance to funding governments by purchasing bonds on a large scale, even in secondary markets, remains strong, as Mario Draghi, the new president of the ECB made plain in his interview with the FT on December 18.

Nevertheless, he argued, the ECB took important action the week before:

More

Financial Times

December 28, 2011